Technology and

Commercialisation Readiness Tool

Our technology and commercialisation readiness evaluation tool enables you to assess the state of your product or service development and your progress towards commercialisation while giving you the confidence of developing an action plan.

Review your innovation management processes

Identify areas for improvement

Gain useful insights

Design actions

In today’s competitive landscape, bringing innovation to market demands more than just a great idea - it requires a balanced, data-driven understanding of both technological maturity and commercial viability.

Our TRL and CRL Evaluation Tool is a powerful innovation analytics solution that bridges this gap between technology maturity and business readiness by evaluating your project across two critical axes:

- Technology Readiness Level (TRL)

- Commercial Readiness Level (CRL)

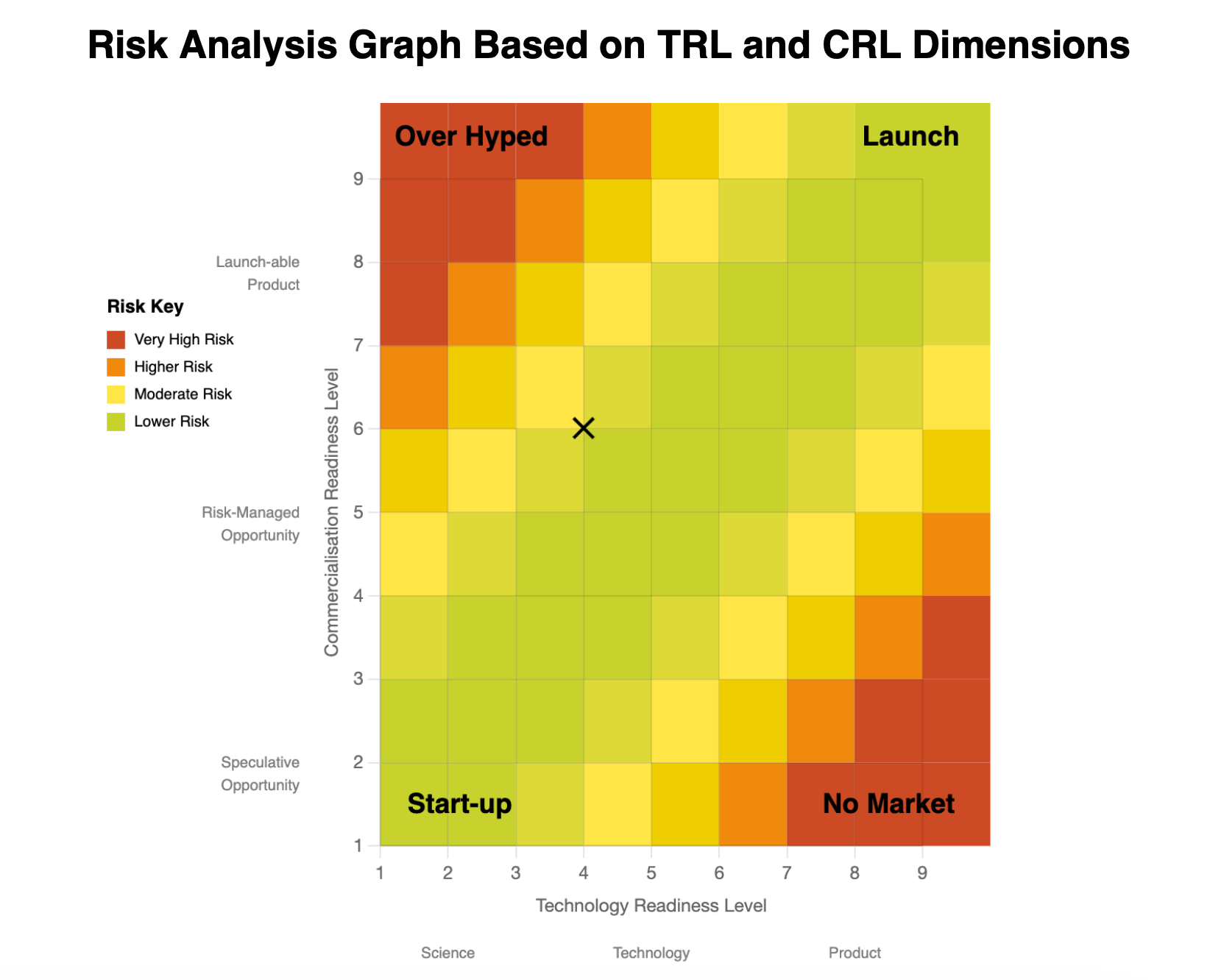

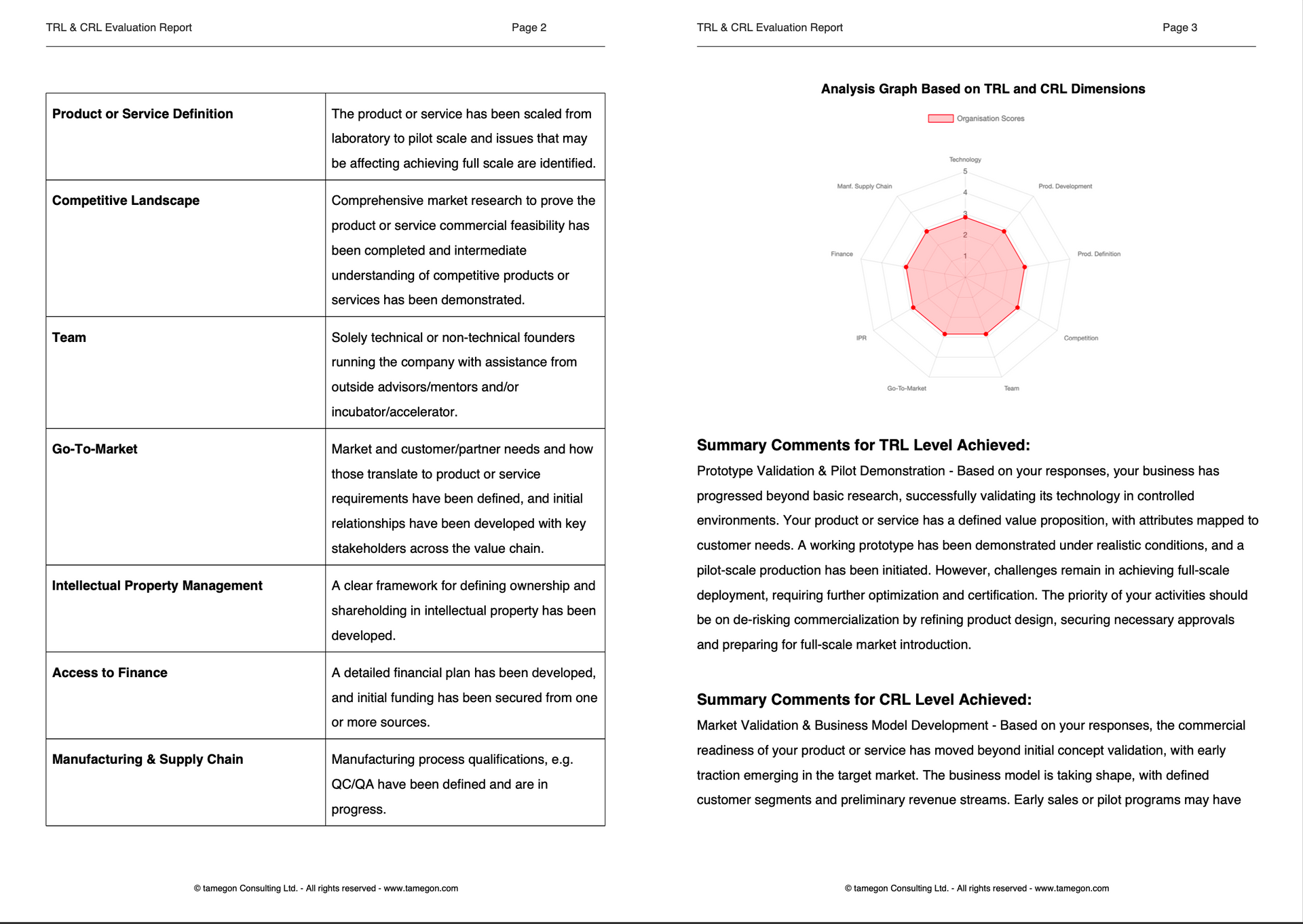

Unlike traditional tools that focus solely on technology, this dual-assessment approach helps you visualise imbalances, uncover hidden risks, and align your technical progress with go-to-market strategies. The tool assesses your innovation project across nine key dimensions, each supported by five targeted statements, to produce a comprehensive and actionable report.

About the TRL and CRL Evaluation Report

By integrating gap analysis, risk heatmapping, and targeted strategic recommendations, the tool empowers startups, scaleups, and corporate innovation teams to :

- Visualise readiness gaps across technical and commercial dimensions.

- Identify risk levels using a colour-coded TRL-CRL heatmap.

- Receive tailored recommendations for de-risking and accelerating commercialisation.

- Improve investor confidence by demonstrating roadmap clarity and risk mitigation.

Key Features

Based on your responses, it calculates:

- Your TRL and CRL scores (1-9 scale)

- A written interpretation of your project's development status

- A Gap Analysis reflecting whether your technology and commercial strategies are aligned

- A risk heatmap, showing how mismatches between TRL and CRL increase market entry risk

- Tailored recommendations to de-risk, prioritise, and accelerate progress

This powerful platform delivers a data-driven evaluation to help you unlock and accelerate your organisation's innovation potential.

Whether you are a start-up, SME, scaleup, a corporate innovation team or an investor and accelerator, your personalised report will serve as a strategic roadmap - guiding you to strengthen innovation capabilities, bridge critical gaps, and maintain a competitive edge in today's fast-evolving business landscape.

How It Works

1. Complete the Survey

- Enter your organisation name, your department and a brief summary of your product or service innovation (optional but recommended for a personalised experience).

- Evaluate the current technical and commercial development of your product or service by rating targeted statements across nine critical dimensions.

- Provide objective ratings to reflect your project's true stage of technical readiness (TRL) and commercial readiness (CRL).

2. Generate Your Report

- Once the survey is completed, click “Generate Report” to review your input data.

3. Choose and Purchase Your Report

- Select the report that best fits your needs:

| Report Type | Essential Report ($9.99) | Strategic Report ($49.99) |

|---|---|---|

| TRL and CRL Evaluation (Based on responses to statements) | ✅ | ✅ |

| Summary TRL and CRL Comments | ✅ | ✅ |

| Gap Analysis (Reflection on technological and commercial maturity) | ✅ | ✅ |

| Dynamic Risk Analysis (Categorisation on risk matrix and recommendation) | ❌ | ✅ |

| Tailored Recommendations and Insights | ❌ | ✅ |

- Secure your report via our trusted PayPal gateway.

4. Download Your Report

- Once your payment is processed, click "Save Report" to download your personalised PDF report.

- Choose a location on your device to save it for easy access.

Why Choose Us?

Our tool does not just measure how advanced your technology development is - it also checks whether your business is ready to support it. By calculating your TRL and CRL levels, and mapping them on a risk heatmap, we highlight the misalignments that block commercialisation. Whether your technology is ahead of your market plan or your business case is running without a validated product, our tool flags it. It provides:

- Your TRL and CRL scores (1-9 scale).

- A written summary explaining what your scores mean.

- A gap analysis showing if your technology and commercial readiness are in sync.

- A risk heatmap, visually showing the risk level based on the TRL and CRL assessment and the gap between them.

- Tailored recommendations

based on your scores combination.

TRL and CRL Evaluation

For each category, please select the button next to the description that best fits the status of your product or service development. This tool will determine the appropriate TRL and CRL levels based on your answers. Once all categories have been completed, you will have the option to save a PDF report to view your TRL and CRL scores together with personalised actions.

Provide Your Details

Interested in improving your innovation management activities?

We are here to help!

Contact us to discuss how our innovation survey tool can allow you to gain useful insights unlocking your innovation projects potential.